Insights | 26 June 2025

The India-EFTA Trade and Economic Partnership Agreement: what does it mean for Swiss businesses?

The India-EFTA Trade and Economic Partnership Agreement opens up new opportunities for Swiss companies operating in India or seeking to enter the Indian market — but companies must be strategic to maximise benefits and mitigate risks.

Overview of the agreement

The Trade and Economic Partnership Agreement (TEPA) — a landmark free trade agreement between India and the European Free Trade Association (EFTA) states (Switzerland, Norway, Iceland and Liechtenstein) — is expected to come into force in the autumn of 2025.

Switzerland, as India’s largest trading partner among the EFTA states, stands to benefit considerably from the agreement.

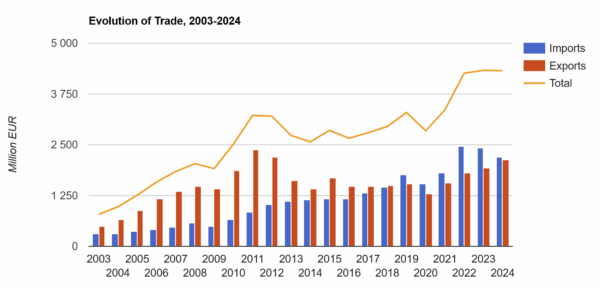

Evolution of trade between Switzerland and India: 2003-2024[1]

Trade between Switzerland and India has seen substantial growth in the last 20 years and, in 2024, totalled over EUR 4.3 billion. Switzerland’s most significant exports to India include machinery, watches, medical devices and instruments, and pharmaceutical products, with India exporting mainly organic chemicals, electrical machinery and textiles to Switzerland.

TEPA is expected to further bolster trade between the two countries and create new opportunities for both Swiss and Indian businesses.

Swiss businesses are likely, however, to face competition in the Indian market from other global players. Over the last few years India concluded a number of bilateral investment treaties (BIT), including a 2020 BIT with Brazil and one with the UAE in 2024) as well as free trade agreements (FTAs). The United Kingdom and India concluded a landmark FTA in May 2025, following over three years of negotiations. The EU has also recently restarted talks with India over a similar trade deal, with expectations of cinching a deal by the end of 2025.

Key highlights of TEPA

TEPA provides a framework for co-operation and trade liberalisation between India and the EFTA states. Its most prominent features include:

- A USD 100 billion investment: over the next 15 years, EFTA states have committed to increase foreign direct investment in India to USD 100 billion, and facilitate the creation of one million jobs in India.

- Tariff reductions: India has agreed to gradually eliminate the majority of tariffs on imports from EFTA states. This makes Swiss exporters more competitive in the Indian market, particularly for machinery, pharmaceuticals, medical devices, precision instruments, and clocks and watches. EFTA states have committed to eliminating customs duties on imports of industrial products, as well as fish and other marine products, originating in India.

- National Treatment and Most-Favoured-Nation Treatment for importers/exporters: the Parties to TEPA have agreed to accord each other National Treatment (NT) in areas such as the trade in goods (incorporating the standards under the WTO General Agreement on Tariffs and Trade 1994 (GATT)) and to accord each other Most-Favoured-Nation (MFN) treatment with respect to customs duties on imports and the supply of services (incorporating Article II of the WTO General Agreement on Trade in Services (GATS)).

- Services and market access: the agreement also includes provisions to facilitate market access to India’s services sector — an area of growing importance to Swiss companies, particularly those in finance, insurance and consulting.

How are investors protected under TEPA?

India and the EFTA states agree to provide each other’s investors with certain advantages:

- Commitment to fostering a favourable investment climate: India expressly “endeavours to ensure a favourable climate for foreign direct investment”. However, this is expressed as a general objective rather than a binding obligation.

- Establishment of a dedicated EFTA-Desk by India: on 10 February 2025, India launched the EFTA Desk to assist and provide support and guidance to investors from EFTA states investing in India. This is meant to serve as a central point of contact to address investor concerns and resolve any issues that may arise. It will also maintain a comprehensive database of investment opportunities.[2]

However, unlike traditional BITs — such as the now-terminated 1997 India-Switzerland BIT — TEPA does not include some of the broader protections that investors have historically relied upon, notably:

- No express protection against expropriation: TEPA does not expressly provide for specific protection against, or rights in case of, expropriation of investment of an investor.

- No guarantee of Fair and Equitable Treatment (FET) or Full Protection and Security (FPS): investors cannot rely on either the generally recognised FET standard, which includes protection from arbitrary or discriminatory conduct or an express right to FPS of their investment.

- No MFN and NT protection for investments: the MFN and NT provisions in TEPA do not expressly extend to investors and their investments.

- No protection against capital flow restrictions: TEPA does not contain firm guarantees to prevent unjustified restrictions on the movement of capital and payments — an issue that can be critical for cross-border investments.

- No Investor-State Dispute Settlement (ISDS): perhaps most importantly, TEPA does not allow investors to bring claims directly against the host state under any international dispute settlement mechanism. While the EFTA Desk has been set up to address investor concerns, where a dispute does arise, investors may either have to turn to India’s domestic courts to challenge a governmental action, or rely on diplomatic channels. A government-to-government consultation mechanism for the resolution of “differences” relating to investor promotion commitments exists, but only in respect of the EFTA States’ commitments — not those of India. The more detailed State-to-State dispute resolution chapter 12 of TEPA does not apply to the investment chapter.

Following the conclusion of TEPA, Switzerland is reportedly pushing to negotiate a new BIT with India that ensures some or all of the above protections for investors.

What should Swiss investors in India be mindful of?

Swiss investors should be aware that TEPA does not replicate the legal protections found in traditional investment treaties. In practical terms, this means investors must plan carefully, including by:

- Performing comprehensive risk assessments: in the absence of robust international protections, investors should undertake thorough risk assessments, particularly on India’s regulatory and legal environment, licensing regimes, and repatriation of funds.

- Structuring investments strategically: companies may wish to explore alternative investment routes — such as routing investments through jurisdictions with active BITs with India — to preserve a broader set of protections. Currently India has 11 active BITs (one of which is not yet in force).

- Considering robust contractual protections: one effective risk-mitigation strategy is to include well-drafted contractual protections, including dispute resolution clauses, in contracts with private and public counterparties. Such contractual arbitration clauses can allow businesses to resolve disputes outside of the local courts and provide greater predictability. Selecting an arbitration-friendly seat such as Singapore, Geneva or London is of particular importance.

- Leveraging political risk insurance: insurance from providers such as SERV (Swiss Export Risk Insurance) can mitigate risks of contract frustration, currency transfer restrictions, and arbitrary revocation or cancellation of licences and permits.

References

[1] European Free Trade Association (2024). Trade statistics: Switzerland–India (2024). Retrieved April 21, 2025, from https://trade.efta.int/#/country-graph/CH/IN/2024/SVHS6

[2] European Free Trade Association (2025). New Business Support Desk to help EFTA companies make the most of TEPA. Retrieved from https://www.efta.int/media-resources/news/new-business-support-desk-help-efta-companies-make-most-tepa

Back to listing